Busting the Biggest Myths in Today’s Housing Market

Busting the Biggest Myths in Today’s Housing Market

We’ve all heard the phrase, “Don’t believe everything you hear,” and when it comes to today’s housing market, that couldn’t be more true. There’s a lot of chatter out there, and not all of it is accurate. Now more than ever, it’s crucial to have a reliable source of information—someone who can guide you through the noise with facts and clarity.

When you work with a real estate agent, they can help you separate fact from fiction. Here’s a closer look at some of the most common myths floating around and why they don’t hold up under scrutiny.

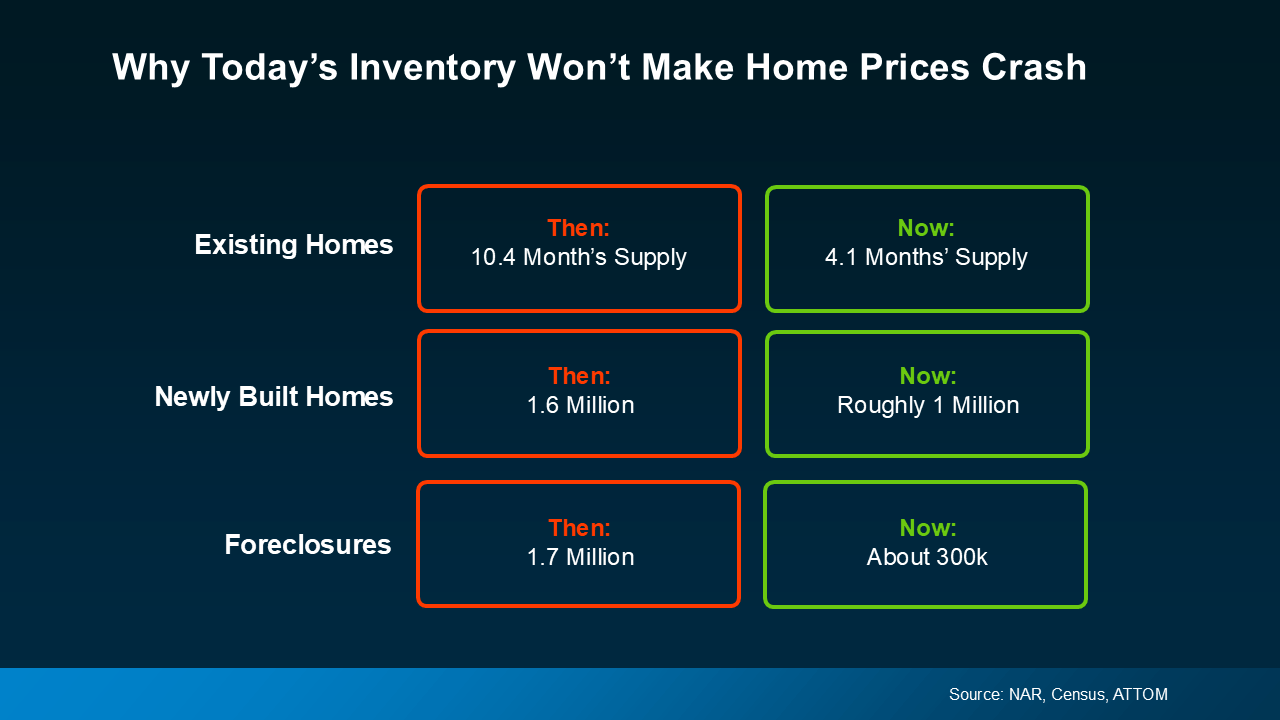

1. Myth: Prices Will Plummet, and I’ll Get a Steal

You might have heard whispers that home prices are on the verge of a dramatic drop. But before you start dreaming about snagging a deal, let’s ground this in reality. While prices fluctuate depending on the market, all signs point to stability, not a crash. Unlike 2008, when an oversupply of homes caused prices to tank, today’s market is experiencing the opposite—there simply aren’t enough homes available (see chart below).

So, if you’re banking on prices taking a nosedive, you might want to reconsider. The data shows that waiting could mean missing out, not cashing in.

So, if you’re banking on prices taking a nosedive, you might want to reconsider. The data shows that waiting could mean missing out, not cashing in.

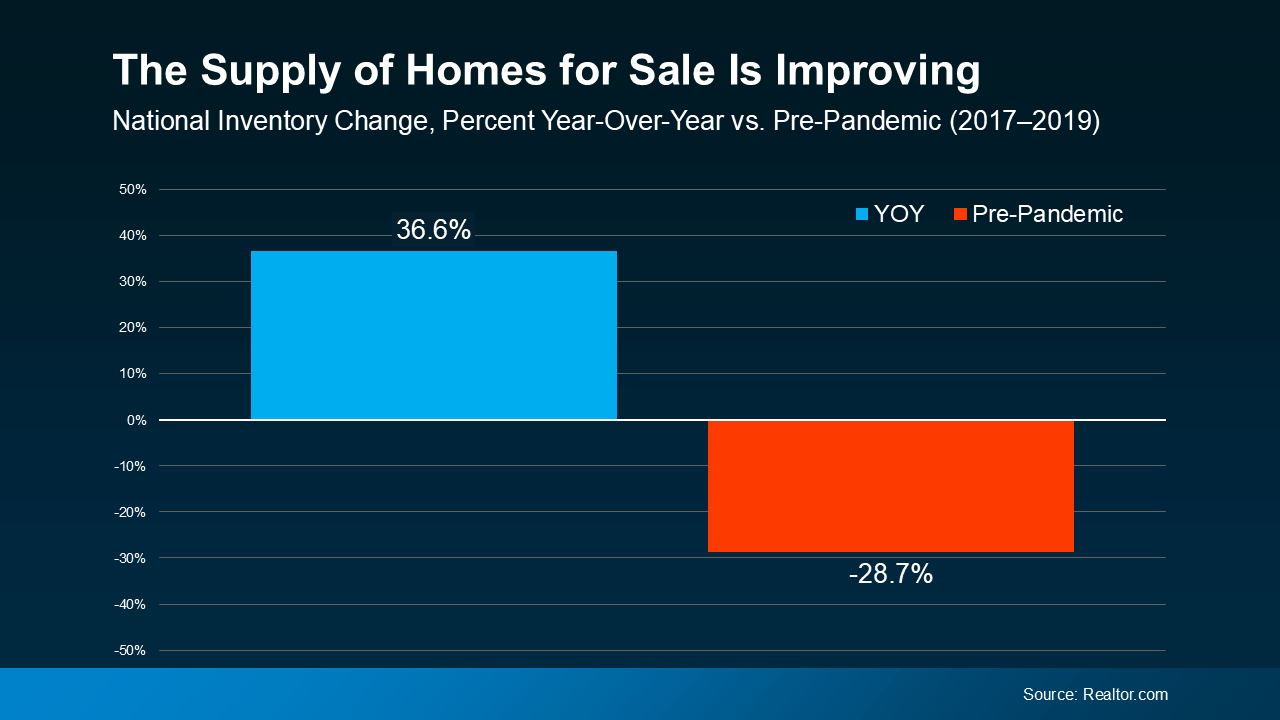

2. Myth: There’s Nothing Out There for Me to Buy

Worried that the perfect home isn’t out there? It’s a common concern, especially with all the buzz about low inventory. But here’s the thing: the number of homes on the market has been ticking up throughout the year. According to Realtor.com, inventory levels, while not quite back to pre-pandemic norms, are still better than they were a year ago (see graph below).

In other words, the landscape is shifting, and your options are expanding. So, if you’ve been feeling like finding a home is an uphill battle, it’s time to take another look. The situation is improving, and with the right guidance, you can find a home that fits your needs.

In other words, the landscape is shifting, and your options are expanding. So, if you’ve been feeling like finding a home is an uphill battle, it’s time to take another look. The situation is improving, and with the right guidance, you can find a home that fits your needs.

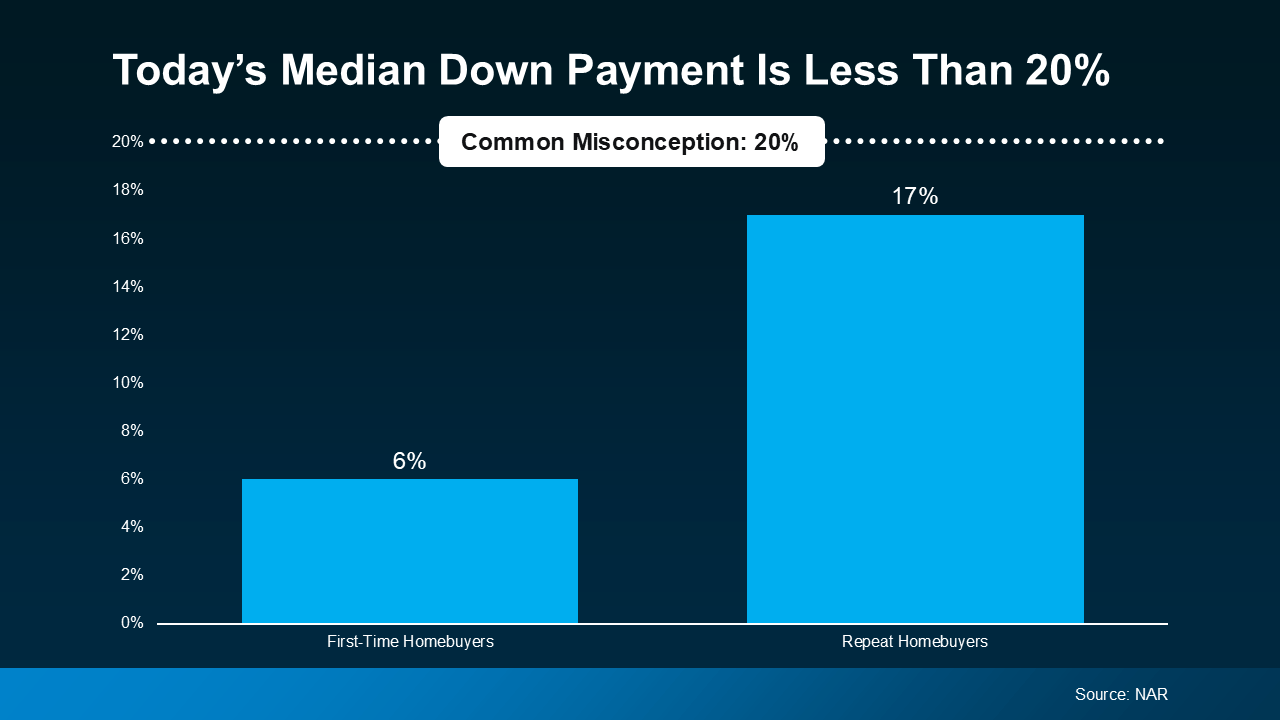

3. Myth: I Need a 20% Down Payment to Buy a Home

This one’s been around forever: the idea that you need to save up a hefty 20% to buy a home. But here’s the truth—most buyers aren’t putting down nearly that much. In fact, Fannie Mae reports that nearly 90% of people overestimate how much they need for a down payment. According to data from the National Association of Realtors (NAR), first-time buyers are typically putting down around 6% (see graph below).

First-time homebuyers are typically only putting down 6%. That’s far less than the 20% so many people think they need.

If you’re seeing that repeat buyers are closer to 20%, keep in mind they’re often using equity from their current home. So unless your lender or loan type requires it, you don’t need to hit that 20% mark. Depending on your situation, you might only need 3.5% or even zero down.

How an Agent Can Help Clear the Fog

If you’ve been holding off on buying or selling because of one of these myths, it’s time for a reality check. A knowledgeable real estate agent can provide the facts, backed by data, to help you move forward with confidence.

Bottom Line

If you’re feeling unsure about what’s true in today’s housing market, let’s chat. You deserve to have the facts, and I’m here to help you get them.

Categories

Recent Posts

"My job is to ensure my clients feel heard, respected and empowered to make the best possible decisions for THEIR family. "